Credit checking offers numerous benefits to your business, including reduced risk, improved cashflow and better customer management.

But what are the costs involved in credit checking Kiwi businesses? And do the returns on business credit reports outweigh the costs?

What’s the return on credit reports?

Companies with high credit scores are 15 times more likely to pay their bills* than companies with low credit scores, based on average credit default data for New Zealand businesses.

If several customers default on their payments to you, it can leave you out of pocket, and the knock-on effect to your cashflow can increase your risk of business failure.

For example, if your company trades with companies in the construction sector, and bills $1,000,000 per annum to customers, you can expect an average default rate of 4.9%, or $49,000 per annum*.

By checking your customers’ credit scores in advance, you can decide to offer credit accounts to only customers with high credit scores. This could potentially reduce your bad debts from $49,000 to only $3,200 per annum, assuming only one in every 15 customers with high credit scores will default on their payments.

You can still choose to trade with businesses that have low credit scores. However, having that knowledge in advance allows you to set appropriate terms of trade, such as cash on delivery rather than payment in arrears, reducing your exposure to risk from late payments.

How much do business credit reports cost?

One-off business credit checks start from $49 +gst by credit card. If you plan to credit check new business customers regularly, we recommend opening an account and paying just $30.50 +gst per business credit report. It is free to open an account with no ongoing fees, simply pay for what you use, and you can cancel your account any time.

For this investment, you get an overview of each customer’s payment history before you sign any agreements with them. You can see the company’s credit score, outstanding debts, any payment defaults, and outstanding amounts owing.

Having this transparency before you do business with a new customer puts you in the best position to negotiate favourable terms of trade and make sure you protect your cashflow.

How do business credit reports help me manage risk?

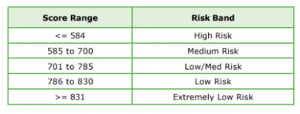

Business Credit Reports feature a credit score – a summary of the information in the report, designed to provide a snapshot of a company’s creditworthiness. The credit score helps you predict the likelihood of businesses defaulting or failing in the next 12-24 months.The lower the number, the higher the risk. By having this information in advance, you can protect future cash flow.

In conclusion

Over the course of a year, the savings made from running initial credit checks on business customers far outweigh the upfront costs and can offer peace of mind to Kiwi business owners.

Get credit reports online

To get a credit report and access the credit score and creditworthiness rating of a person or business before extending credit, visit https://www.centrix.co.nz/get-reports

Every business has a credit score – the higher the score, the greater your cashflow protection.

*Data sources:

Information about default rates in this article are industry averages based on publicly available data (such as judgements and Companies’ Office information) and statistical information from Centrix’ database. Individual company’s default rates will vary and so industry averages should not be relied upon by you for any financial decisions (including giving credit or recovering debt).