As AML/CFT (Anti-Money Laundering / Counter Financing of Terrorism) requirements continue to evolve and rates of fraud increase, it’s becoming more important to know your customer. This coupled with greater expectations from customers to have a seamless experience, calls for quick customer onboarding through reliable systems and processes.

Digitally onboarding new customers removes the friction and cost of manual checking, while providing a seamless customer experience.

When digitally onboarding new customers, genuine identity verification is crucial as a defence against fraud. Here are some key steps you can take to help reduce fraudulent applications and assist AML compliance.

Identity document verification

Centrix SmartID allows your customer to scan and capture information from a New Zealand Government-issued identity document such as a Driver’s License or Passport. SmartID then verifies the authenticity of the document to reduce your exposure to fraud. For accurate document identity verification, your business requires access to a comprehensive New Zealand Government database.

Identity data verification

Combining document verification with additional trusted data sources such as credit data held on the Centrix database, adds another layer of protection that will assist with AML/CFT compliance.

Identity authentication / linking

As well as checking that this is a genuine identity against data sources, you need to check that the person applying is actually who they claim to be, particularly in a digital environment.

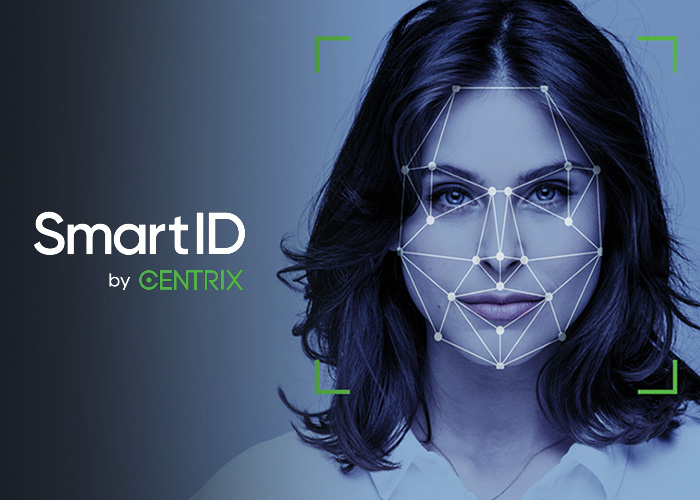

Facial recognition and liveness checks, for example, will confirm the applicant’s identity against the Government ID source, so you have confidence they are who they say they are.

How to get your customer onboarding right

Centrix SmartID with optional biometrics provides a secure, streamlined way to digitally verify the identity of your customers.

Whether you have an obligation to meet AML/CFT (Anti-Money Laundering / Counter Financing of Terrorism) New Zealand legislative requirements, or are worried about levels of online application fraud, SmartID can help.

SmartID provides you with a safe and reliable way of automating customer identity verification – and optional biometrics provides your customers the ease of completing a reliable identity verification process from the comfort of their own home.

For more information, visit www.centrix.co.nz/smartid. Or contact your Centrix account manager, email sales@centrix.co.nz or call 0800 236 874.