A consumer credit report summarises how often a person has bought products or services on credit, and how reliable they are at paying for these items. If you’re considering offering money, goods or services on credit to a consumer, it’s the best way to know how likely they are to pay their bills on time.

The information in consumer credit reports is collected from multiple sources including banks, utility companies, debt collection agencies and payment history data from creditors. Anyone who supplies goods or services to people on credit and collects payment in arrears can be a creditor, such as utility companies, banks, finance companies, and suppliers of goods and services.

Centrix consumer credit reports include personal information, credit score, and information on any defaults and judgements. They can also include payment history, ID verification, and information about any companies with which the person is affiliated, either as a shareholder or director.

The report features a credit score, which is a number between 0 and 1,000 that indicates how likely the person is to pay their bills on time. The higher the score, the better the credit rating. Risk odds are also provided, which give you the odds of a person defaulting or getting in arrears. For example a score of 6:1 means there’s a one in six chance that the person will default or get into arrears if you provide them goods or services on credit.

Centrix consumer reports include the following information:

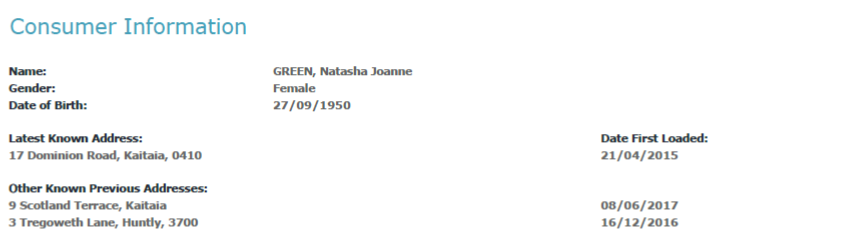

- Consumer Information

The report contains any unique information you might need to identify a person, such as their name, address, and date of birth. If the person has gone by previous names, or listed other addresses on their financial records, these are also shown.

Example report

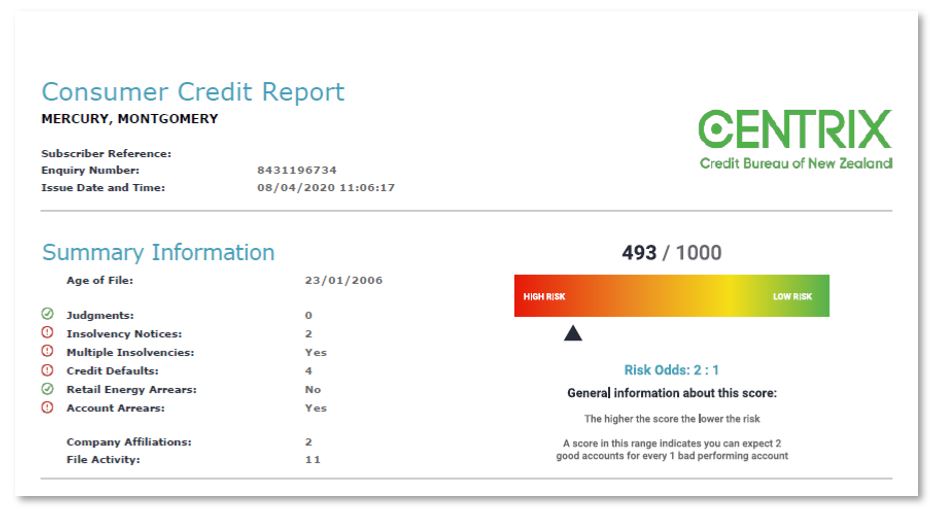

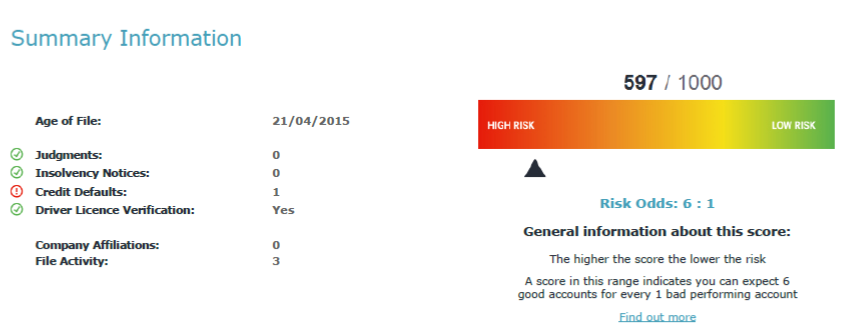

- Summary Credit Information and Credit Score

The summary section shows a person’s recent credit history at a glance, including their current credit score, as well as any defaults, insolvencies and judgements, if applicable.

The credit score is a summary of the information in the report, designed to provide a snapshot of a person’s creditworthiness. The credit score helps you predict the likelihood of a person defaulting or failing in the next 12-24 months. The lower the number, the higher the risk.

Example report

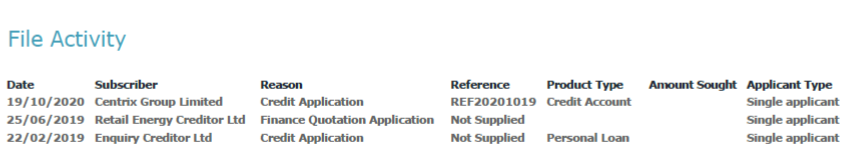

- File Activity

The number of credit enquiries is included in the report. This helps to identify how many times a person has applied for credit in recent years.

Example report

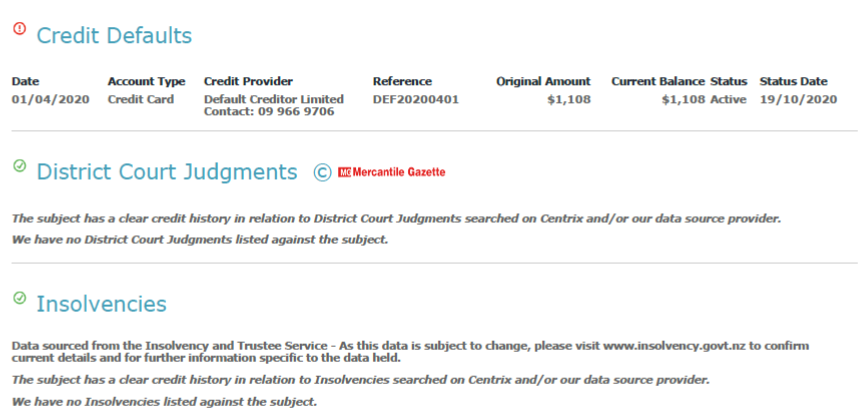

- Defaults, Judgements, and Insolvencies

All judgments and defaults are also listed, to give you more insight into a person’s financial track record, and when they have failed to make payments to other suppliers or credit providers. Any consumer who has a recent default, judgement or insolvency should raise a red flag in your approvals process, and trigger further investigation as to why that situation occurred, and if it’s likely to happen again.

Example report

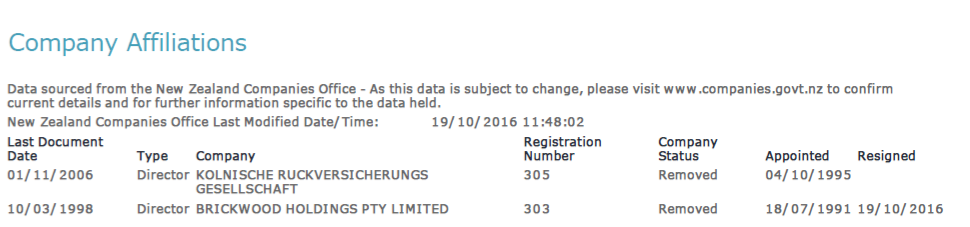

- Company Information

Any director or shareholder affiliations from the Companies Office are reported, including general company information such as registered name, trading name and address.

Example report

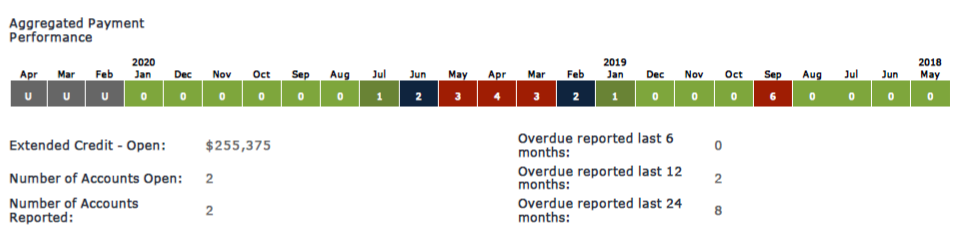

- Account Payment Information

Detailed account payment information is included in some Centrix Consumer Reports (those with Comprehensive Credit Reporting), including the amount owed on account for each period, payments made on time, and overdue payments for each period. This information is only available to businesses who share payment information about their own customers.

Example report

How can Centrix consumer credit reports help your business?

Centrix consumer credit reports give you key insights to enable your risk assessment for new account applications and can be a helpful tool when vetting potential new employees. The reports give you deep insights into a person’s past credit behaviour, a summary of frequency of credit enquiries, type of accounts and/or dollar value businesses have previously applied for, delivered in an easy-to-read format.

In general, credit reports and credit scores are useful tools for any business that wants to loan money or extend goods or services to a consumer or business on credit, and on what terms. Businesses who want to protect cashflow are unlikely to offer credit to a person or business with a low credit score, as there is a high risk that this won’t be paid back.

Get credit reports online

Centrix credit reports are real-time, cost efficient and can be purchased one off via a credit card, or on account. To get a credit report and access the credit score and creditworthiness rating of a person or business before extending credit, visit here.

Every consumer and business has a credit score – the higher their score, the greater your cashflow protection.