Business credit reports explained

A business credit report is a summary of a business’s credit activity, which covers a broad range of financial activity. Centrix business credit reports include a company’s payment history, current credit situation, and information about the company such as registration status and directors affiliations.

Business credit reports are created by collecting information on businesses from multiple sources including the NZ Companies Office, PPSR, debt collection agencies and payment history data from creditors. Anyone who extends credit to a person or business can be a creditor, such as utility companies, banks, credit card companies, and suppliers of goods such as raw materials or transportation services.

These reports are used by savvy businesses to help them decide whether to offer another business credit based on their potential risk of payment default. The report features a credit score, which is a number between 0 and 1,000 that indicates how likely the business is to pay their bills on time. The higher the score, the better the credit rating.

So what does a business report from Centrix include?

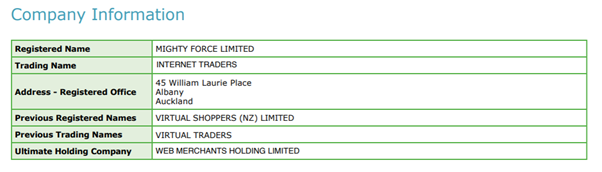

- Company Information

General company information such as registered name, trading name and address are included. Reports also include any previous trading names and the ultimate holding company, allowing lenders to discover any financial links that may affect credit decisions.

Example report

Important information available from the Companies Office is included in the business credit report, including the company number, industry classification (BIC) code, and the number and details of key directors and shareholders. Shareholder affiliations are listed, to help you identify any related shareholdings, such as holding companies or family trusts.

Directors’ personal credit reports can also be accessed with written permission, and a Beneficial Owners Report can be created to trace the company tree and provide a clear summary of a company’s ownership structure.

Example report

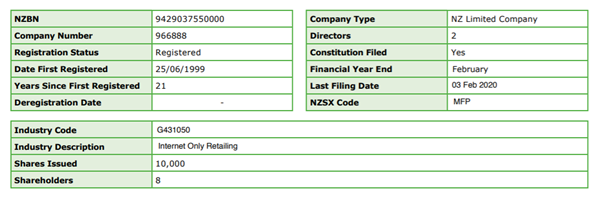

- Summary Credit Information

The summary section helps you to see a business’s recent credit history at a glance, including the company’s current credit score, as well as any defaults, insolvencies and judgements. Personal Property Securities Register (PPSR) records mean that at least one of the company’s assets have securities loaded against them, details of which are also included in a Centrix report.

Example report

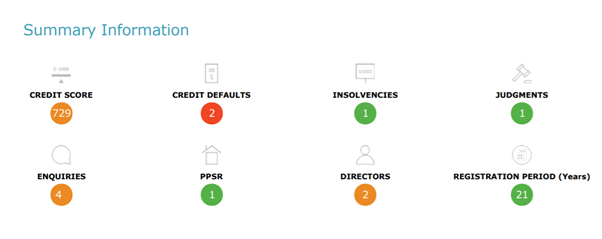

- Credit Score

Centrix business credit reports feature a credit score – a summary of the information in the report, designed to provide a snapshot of a company’s creditworthiness. The credit score helps you predict the likelihood of businesses defaulting or failing in the next 12-24 months. The lower the number, the higher the risk. By having this information in advance, you can protect future cashflow as you identify which of your business partners are at risk of non payment.

This information is crucial to assist making informed decisions about who to extend credit to, as well as setting appropriate terms of trade. It also allows you to have a conversation early with customers, before payments are missed. A good credit rating can also be an indication of a reliable supply chain.

A table of score ranges is included in the report, to help you interpret the credit score at a general risk level, as well as the likely rate of default.

Example report

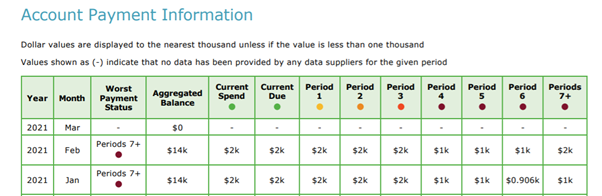

- Account Payment Information

Detailed account payment information is included in the Centrix report, including the amount owed on account for each period, and a summary of overdue payments for each period.

This information is only available to businesses who share payment information on their own customers.

Example report

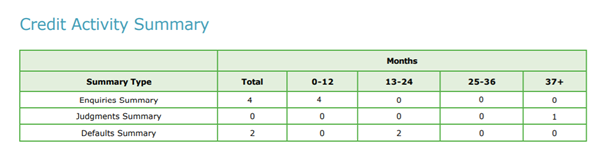

- Enquiries, Judgements and Defaults

Details of the number of enquiries are included in the report. This helps to identify how many times a company has applied for credit in recent years. Any judgments and defaults are also listed, to give you a complete picture of a company’s financial track record, and when they have failed to make payments to other suppliers or credit providers. This information provides more context to the credit score – it’s possible to see whether any payment defaults are recent or historical, giving you more certainty about the risk of extending credit to a business.

The summary section provides details at a glance, and the detail is provided in the sections further in the report.

Example report

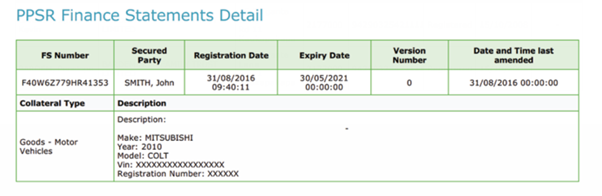

- PPSR (Personal Property Securities Register)

Details of the number of securities are included in the report. PPSR is a register that lets individuals and businesses know if personal property such as cars, goods or company assets have security interests over them.

Registering your security interest correctly on the PPSR can protect you and give you extra rights in the property it’s registered over.

The summary section provides details at a glance, and the detail is provided in the sections further in the report.

Example report

How can business credit reports help your business?

Centrix business credit reports give you key insights to enable your risk assessment for new account applications and new supplier arrangements. The reports give you deep insights into a company’s past credit behaviour, a summary of frequency and time frames of credit enquiries, type of accounts and/or dollar value businesses have previously applied for, delivered in an easy-to-read format.

Credit reports and credit scores are useful tools for any business that wants to loan money or extend goods or services to a consumer or business on credit, and on what terms. Businesses who want to protect cashflow are unlikely to offer credit to a person or business with a low credit score, as there is a high risk that this won’t be paid back.

Get credit reports online

Centrix business credit reports are real-time, cost efficient and can be purchased one off via a credit card, or on account. To get a credit report and access the credit score and creditworthiness rating of a person or business before extending credit, visit https://www.centrix.co.nz/get-reports/

Every business has a credit score – the higher the score, the greater your cashflow protection.